As a landlord, many things can go wrong. For example, you may get damage to your property, it may become uninhabitable, renters may not pay, or you may even get a compensation claim should someone have an accident.

All of those examples have very expensive consequences. Thankfully, that’s where insurance can help. But what is the cost of property rental insurance in Ontario, and what does it cover? Read on to find out all the answers.

The Cost of Rental Property Insurance in Ontario

It’s hard to put a figure on exactly what you’ll pay for property insurance in Ontario. There is a wide range of factors that go into the cost. Due to this, it’s the best idea to get a quote from an insurer and go from there.

That being said, the average price of property insurance is a little over $1,000 per year. However, if you were renting out a large property, including every coverage add-on, and there were some additional risk factors, then you may have to pay much more than that.

On the flip side, you may be renting out a smaller apartment with minimal coverage and little to no risk factors. In this scenario, your payments would be lower. Let’s take a look at the coverage options available and what affects the cost.

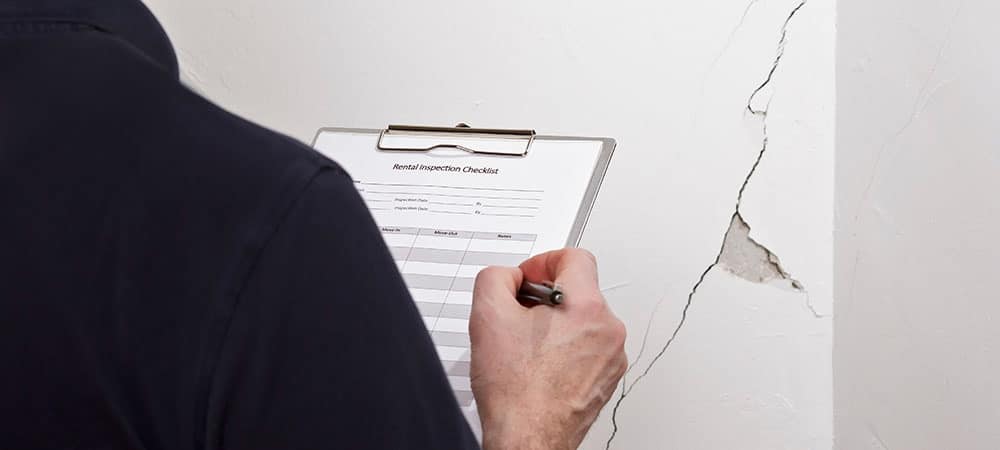

What Is Rental Property Insurance for?

Rental Property Insurance, also called landlord insurance, is there to protect you from loss of income and unexpected costs. There are several things you may be covered for, but here are the most important:

Loss of rental income – There are reasons why your property may become uninhabitable. For example, your property may be flooded, and you can’t let it out until repairs are completed. This policy can pay you for the income you otherwise would have had.

Property coverage – This coverage will protect you from damage to the property. For example, the property was burgled and damaged. Another example would be a house fire. In these circumstances, the insurer can help pay for the repairs.

Landlord belongings – Did you let out a furnished property? If so, you may have your own goods in there, such as a sofa, cooker, and washing machine. With comprehensive coverage, these are costs that can be covered.

Liability coverage – There’s always the possibility of legal action. A loose stairway step, railings breaking, a slippery surface. No matter how careful you are, accidents happen. Protect yourself with liability coverage.

Additional Insurance Add-Ons

Along with the standard parts that you’d expect from comprehensive coverage, there may be additional policy features you can add. It’s important to know that these all come at an extra cost.

Flood insurance – If you live in an area that is prone to flooding, then it will often be excluded from your coverage. It’s usually best to add this to your policy if there is any kind of flood threat, as the damage from one can be devastating.

Earthquake insurance – As with floods, this is often excluded. The risk of an earthquake in Ontario is very low, and therefore there is little point in adding it to a policy. If you have a property in another area, it may be worth considering.

Extended contents insurance – This isn’t usually applicable to landlords, but you may want extended contents insurance for high-value goods. If you store precious items on the property, then it can be a good idea.

Non-payment of rent – One of the biggest fears a landlord will have is when their tenants simply refuse to pay. Knowing you have this as part of your insurance policy will help you give you peace of mind.

What Won’t Be Covered by Landlord Insurance?

If you’re considering rental property insurance, then you’re probably wondering what isn’t covered. As we’ve just looked at, damage from floods and earthquakes usually won’t be covered unless you’ve added them to your policy.

However, one thing you don’t need to worry about is the tenant’s possessions. If they have their own property broken or stolen, then they’ll need to have this covered under their own renter’s insurance. You will not be liable for it.

Other things not covered by landlord insurance include the general wear and maintenance of the building. Also, if the tenant intentionally damages the property, then that won’t be covered either, but legal action can be taken to try and recover the cost of repairs.

Other Factors That Affect Insurance Cost

Now you know what policy factors affect the cost of insurance, what other factors determine the cost of your policy? Let’s take a look.

Location – There will be a risk assessment of your property based on several considerations. One of them will be located, as places with higher crime rates often have higher insurance premiums.

Size – Generally, the larger the building, the more that can go wrong. Due to this, expect to pay more for insurance. This is especially true if the building is going to have multiple tenants.

Type – This is linked in with size, but apartments are usually cheaper than houses. Also, commercial buildings can often be the target of crime and vandalism, and therefore a higher premium would be paid than on residential buildings.

Additional Risk Factors – They will also look at additional risk factors to see if there is anything they should be concerned about. This can include the existing condition of the building, including its age.

How to Get Cheaper Rental Property Insurance

Are you worried about the cost of rental property insurance? If so, there are some things you can do to keep costs down.

Bundles – Do you have multiple properties? Or perhaps you want to combine rental property insurance with other types of insurance? If so, you can see what deals your insurer has when you want to combine policies.

Check Your Add-ons – Go through each of the optional extras and see which ones you really need, and which you can leave out. For example, if you’re living in Ontario, you’re not going to need earthquake insurance.

Large Deductible – The deductible is an upfront fee you pay to make a claim on your policy. The higher it is, the less your monthly payment will be. However, you need to ensure you’ll have the funds available to pay the deductible.

Stay On Top of Maintenance – Having a low-risk property and no history of claims can reflect well on your application. Not only will you have fewer financial headaches if you keep the property well-maintained, but you’ll also get a cheaper policy too.

Final Thoughts

The cost of rental property insurance in Ontario averages out at around $1,000 per year, but it can be considerably less or more than that, depending on your circumstances. Hopefully, now you have a better idea of what you’ll be paying and how you can get a cheaper quote.